Debt

Debt structure

Net Debt

As of December 31, 2024, Rexel’s consolidated net debt stood at €2,483.9 million, as a result of €3,220.9 million gross debt minus €883.3 million cash and cash equivalents, and plus €146.3 million of other items.

| (in millions of euros) | Dec 31 2024 | Dec 31 2023 | Dec 31 2022 | Dec 31 2021 | Dec 31 2020 |

| Senior notes | 1,378.8 | 1,370.1 | 953.2 | 999.5 | 1,105.5 |

| Schuldschein | 200.0 | – | – | – | – |

| Senior Credit Agreement | 80.0 | 50.0 | – | – | – |

| Securitization | 1,3361.1 | 1,183.5 | 1,183.5 | 905.0 | 818.4 |

| Medium Term Notes | 60.6 | 49.9 | – | – | – |

| Commercial paper | 34.8 | 34.9 | 45.0 | 125.5 | 50.0 |

| Other debt & cash | (597.7) | (726.9) | (723.3) | (478.8) | (639.0) |

| Net financial debt | 2,483.9 | 1,961.5 | 1,458.4 | 1,551.2 | 1,334.9 |

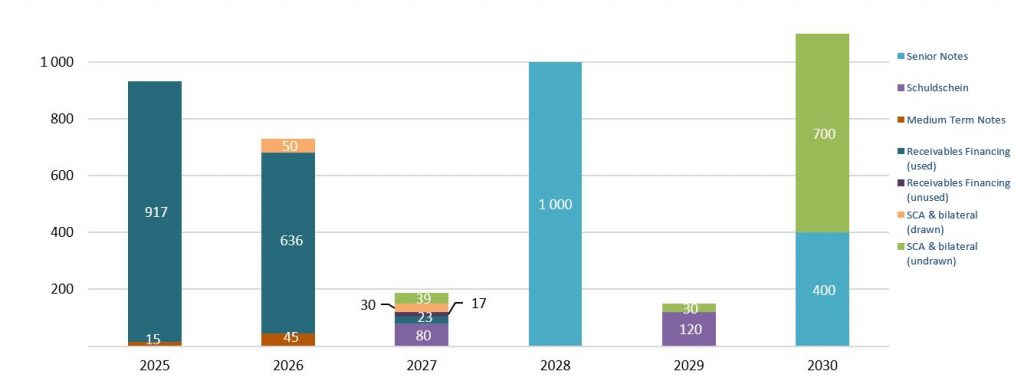

Financing maturity profile

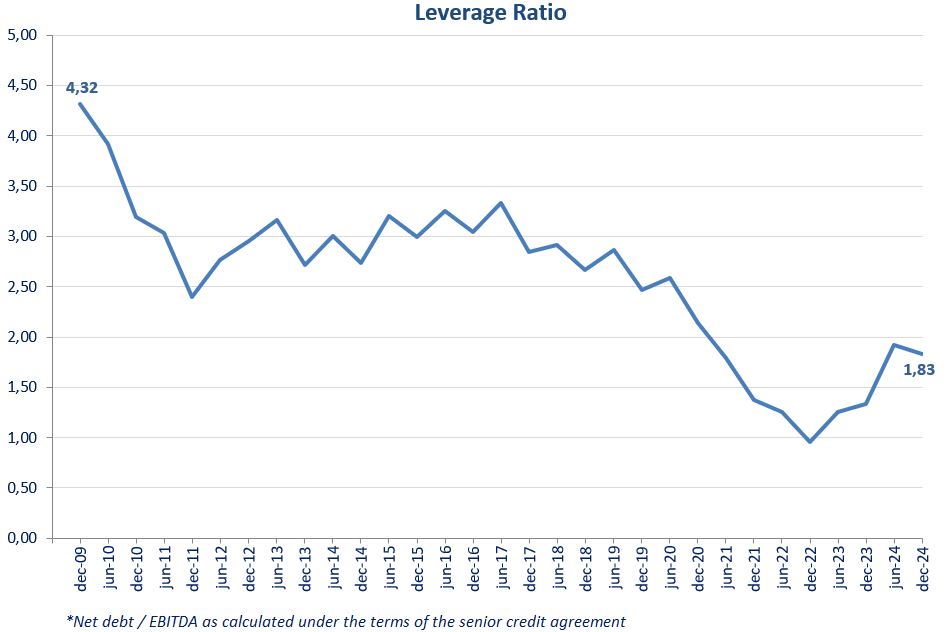

Leverage ratio

On December 31, 2024, Rexel’s leverage ratio* stood at 1.83x.

Financing Instruments as of December 31, 2024

Commercial paper

| Date of implementation | Size of the program (in millions of currency) |

Outstanding amount (in millions of currency) |

Documentation |

| September 2010 | EUR 300.0 | EUR 35.0 | Documentation Financière* (download) |

*French version only

Neu MTN

| Date of implementation | Size of the program (in millions of currency) |

Outstanding amount (in millions of currency) |

Documentation |

| June 2022 | EUR 100.0 | EUR 60.0 | Documentation Financière** (download) |

**French version only

Senior Credit Agreement*

| Maximum Amount (in million euros) |

Drawn amount | Maturity |

| EUR 700.0 | EUR 0.0 | January 23, 2029 |

* Senior Credit Agreement extended to 23 January 2030 in January 2025.

Senior Notes

| Nominal amount (in millions) |

Maturity | Coupon | Rating | ISIN | 1st call date | |

| Moody’s / S&P | Regulation S | 144A | ||||

| EUR 400.0 (download) |

Jun 15, 2028 | 2.125% | Ba1 / BB+ | XS2332306344 | N/A | Jun 15, 2024 |

| EUR 600.0 (download) |

Dec 15, 2028 | 2.125% | Ba1 / BB+ | XS2403428472 | N/A | Dec 15, 2024 |

|

Sept 15, 2030 |

5.25% |

Ba1 / BB+ |

XS2655993033 |

N/A |

Sept 15, 2026 |

|

Listing: Luxembourg Stock Exchange – Euro MTF market

Sustainability-Linked Bond

Redemption of Senior Notes

Download the 2.75% EUR Senior Notes due 2026 full redemption price notice – ISIN code: Reg S XS1958300375

PDF — 99 KB

DownloadDownload the 2.125% EUR Senior Notes due 2025 full redemption price notice – ISIN code: Reg S XS1716833352

PDF — 103 KB

DownloadDownload the 2.125% EUR Senior Notes due 2025 partial redemption price notice – ISIN code: Reg S XS1716833352

PDF — 168 KB

DownloadDownload the 2.625% EUR Senior Notes due 2024 full redemption price notice – ISIN code: Reg S XS1574686264

PDF — 324 KB

DownloadDownload the 2.625% EUR Senior Notes due 2024 conditional full redemption notice – ISIN code: Reg S XS1574686264

PDF — 688 KB

DownloadDownload the 3.50% EUR Senior Notes due 2023 full redemption notice – ISIN code: Reg S XS1409506885

PDF — 137 KB

DownloadDownload the 3.25% EUR Senior Notes due 2022 full redemption notice – ISIN code: Reg S XS1238996018

PDF — 159 KB

DownloadDownload the 5.25% USD Senior Notes due 2020 full redemption price notice – ISIN code: Reg S USF75549AC34 - Rule 144A US761679AC37

PDF — 305 KB

DownloadDownload the 5.25% USD Senior Notes due 2020 partial redemption price notice – ISIN code: Reg S USF75549AC34 - Rule 144A US761679AC37

PDF — 267 KB

DownloadDownload the 5.125% EUR Senior Notes due 2020 redemption price notice – ISIN code: Reg S XS0908821639 - Rule 144A XS0908821985

PDF — 422 KB

DownloadDownload the 6.125% USD Senior Notes due 2019 redemption price notice – ISIN code: Reg S USF75549AA77 - Rule 144A US761679AA70

PDF — 278 KB

DownloadDownload the 7% EUR Senior Notes due 2018 redemption price notice – ISIN code: Reg S XS0629656496

PDF — 90 KB

DownloadDownload the 8.25% EUR Senior Notes due 2016 redemption price notice – ISIN code: Reg S XS0473749959

PDF — 74 KB

Download

Issuer Credit Ratings

| Agencies | Long term rating | Short term rating | Outlook | Releases |

| Moody’s | Ba1 | – | Stable | August 27, 2024 |

| Standard & Poor’s | BB+ | B | Stable | August 27, 2024 |

Further information

Quarterly financial documentation

Half-year financial documentation

Annual financial documentation

Financial press releases

Investors page