Debt

- Quick access:

- Debt structure

- Financing instruments

- Issuer Credits Ratings

Net debt

As of December 31, 2025, Rexel’s consolidated net debt stood at €2,631.4 million, as a result of €3,625.3 million gross debt minus €1037.5 million cash and cash equivalents, and plus €43.6 million of other items.

(in millions of euros) |

Dec 31, 2025 |

Dec 31 2024 |

Dec 31 2023 |

Dec 31 2022 |

Dec 31 2021 |

|---|---|---|---|---|---|

|

Senior notes |

1,782.6 |

1,378.8 |

1,370.1 |

953.2 |

999.5 |

|

Schuldschein |

300.0 |

200.0 |

– |

– |

– |

|

Bilateral credit facilities |

20.0 |

80.0 |

50.0 |

– |

– |

|

Securitization |

1,337.1 |

1,336.1 |

1,183.5 |

1,183.5 |

905.0 |

|

Medium Term Notes |

75.3 |

60.6 |

49.9 |

– |

– |

|

Commercial paper |

19.8 |

34.8 |

34.9 |

45.0 |

125.5 |

|

Other debt & cash |

(903.4) |

(606.4) |

(726.9) |

(723.3) |

(478.8) |

|

Net financial debt |

2,631.4 |

2,483.9 |

1,961.5 |

1,458.4 |

1,551.2 |

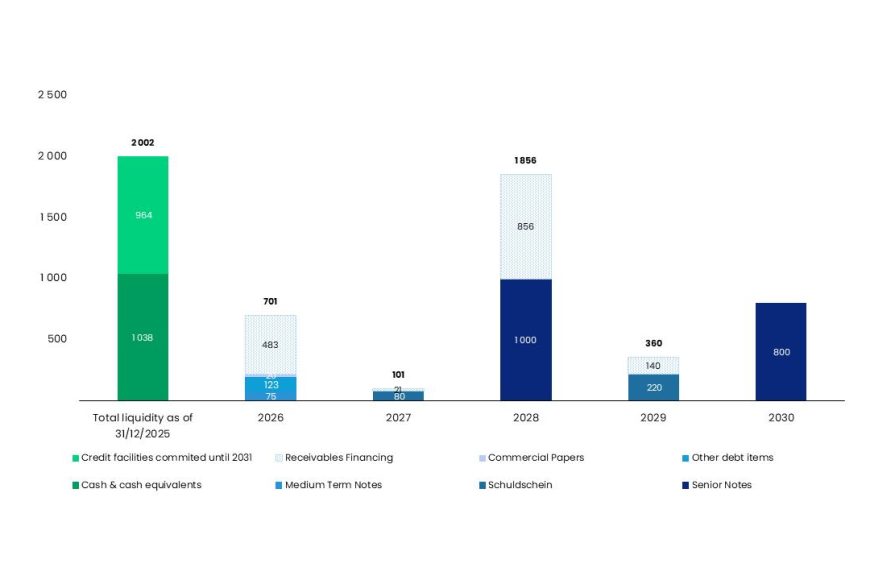

Financing maturity profile

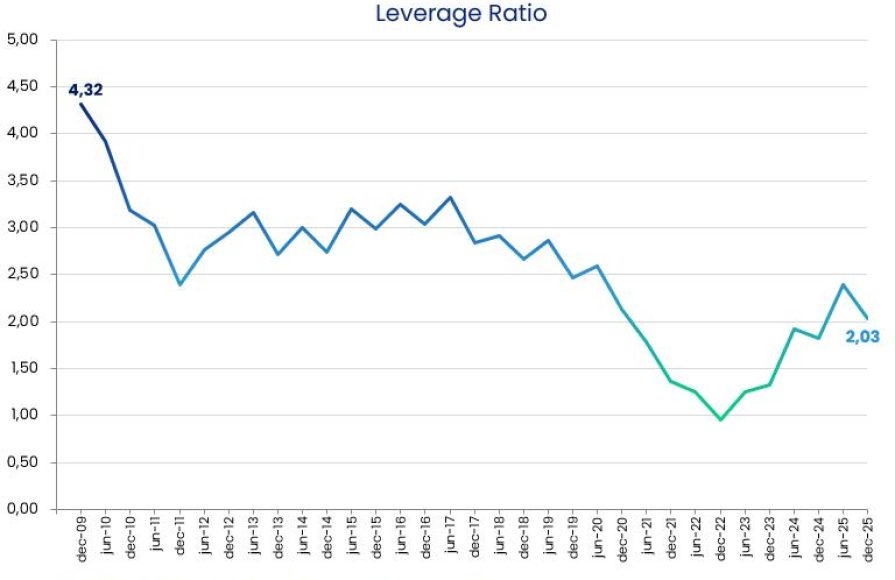

Leverage ratio

On December 31, 2025, Rexel’s leverage ratio* stood at 2.03x.

Financing instruments

as of December 31, 2025

Instrument |

Date of implementation |

Size of the program (in millions of currency) |

Outstanding amount (in millions of currency) |

Documentation |

|---|---|---|---|---|

|

Commercial paper |

September 2010 |

€ 300.0 |

€ 20.0 |

Documentation Financière* |

|

Neu MTN |

June 2022 |

€ 300.0** |

€ 75.0 |

Documentation Financière* |

*French version only / ** Neu MTN Program size increased to €300m from €100m on July 30th, 2025

Senior Credit Agreement*

étendu au 23 janvier 2030 en janvier 2025.

Maximum Amount (in millions) |

Drawn amount |

Maturity |

|---|---|---|

|

EUR 900.0 |

EUR 0.0 |

January 23, 2031 |

* Senior Credit Agreement increased from EUR 700m to EUR 900m and extended to January 23, 2031 in December 2025.

Senior notes

Nominal amount (in millions) |

Maturity |

Coupon |

Rating (Moody’s / S&P) |

ISIN (Regulation S / 144A) |

1st call date |

|---|---|---|---|---|---|

| EUR 400.0 |

Jun 15, 2028 |

2.125% |

Ba1 / BB+ |

XS2332306344 | N/A |

Jun 15, 2024 |

| EUR 600.0 |

Dec 15, 2028 |

2.125% |

Ba1 / BB+ |

XS2403428472| N/A |

Dec 15, 2024 |

| EUR 400.0 |

Sept 15, 2030 |

5.25% |

Ba1 / BB+ |

XS2655993033 | N/A |

Sept 15, 2026 |

| EUR 400.0 |

Sept 15, 2030 |

4.00% |

Ba1 / BB+ |

XS3146987543 | N/A |

Sept 15, 2027 |

Listing: Luxembourg Stock Exchange - Euro MTF Market

Sustainability-Linked Bond

Date |

Sustainability-Linked Bond Framework |

Second Party Opinion on Rexel’s Sustainability-Linked Bond Framework |

Independent practitioner’s limited assurance report on the 2016 baseline |

Independent practitioner’s limited assurance report on the 2023 figures |

Target Satisfaction Notice |

|---|---|---|---|---|---|

|

October 2021 |

Download | Download | Download | Download | Download |

|

April 2021 |

Download | Download | Download | Download | Download |

|

September 2023 |

Download | Download | Download |

Redemption of senior notes

-

The 2.75% EUR Senior Notes due 2026 full redemption price notice – ISIN code: Reg S XS1958300375

June 3, 2025 99 KB

-

The 2.125% EUR Senior Notes due 2025 full redemption price notice – ISIN code: Reg S XS1716833352

June 3, 2025 103 KB

-

The 2.125% EUR Senior Notes due 2025 partial redemption price notice – ISIN code: Reg S XS1716833352

June 3, 2025 168 KB

-

The 2.625% EUR Senior Notes due 2024 full redemption price notice – ISIN code: Reg S XS1574686264

June 3, 2025 324 KB

Issuer Credits Ratings

Agencies |

Long term rating |

Short term rating |

Outlook |

Releases |

|---|---|---|---|---|

|

Moody’s |

Ba1 |

– |

Stable |

August 27, 2025 |

|

Standard & Poor’s |

BB+ |

B |

Stable |

July 21, 2025 |