Residential

New-build and renovation projects for individual and collective housing

Sustainable products

I want to have a selection of sustainable products

Product visualization

I want to visualize what products will look like in the home

Automated pick-up

I want to have automated pick-up solutions in branches

Consigned inventory

I need an onsite branch of consigned inventory

Emergency delivery

I want to have emergency delivery

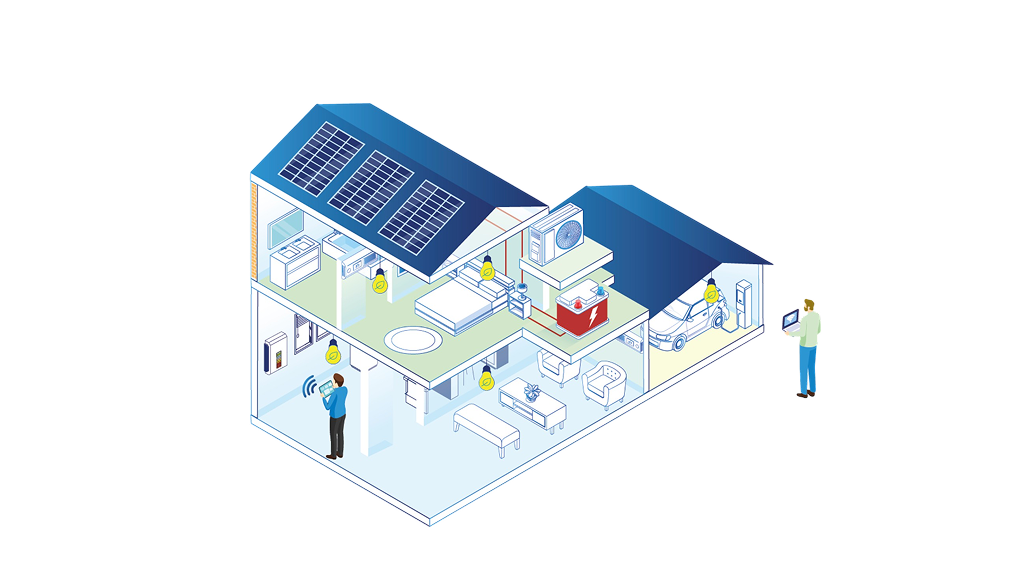

Packaged smart home solutions

I want to install a packaged smart home solution for my clients

Electrical panel maintenance

I need a digital solution to facilitate maintenance of electrical panels

Comfort, security and savings

Our residential customers want to improve the comfort and security of homes while reducing energy consumption through their electrical installations. To achieve these goals, contractors need the right information and training, as well as fast access to the best products and solutions. Our customers range from building owners and residents to the builders, electricians and installers who work for them.

Innovation and multi-channel service

We serve customers on site, in local branches and through digital channels, including a mobile app. Using our expertise and AI tools, we provide advice, training and clear information on the most sustainable solutions available. A good example is Sustainable Selection, more than 100,000 products with particularly strong environmental and sustainability performance. We also work with market-leading suppliers to promote innovation and offer the best range of solutions for residential lighting, heating, home automation and security.

Omnichannel experience

Our customers can access products and services anytime, anywhere through their preferred Rexel channels. We offer physical channels, including our network of 1,950+ branches, sales teams, tech centers, and call center. We also offer a wide range of digital channels: automated logistics, webshops, mobile apps, online tools for product configuration, and electronic data interchanges (EDIs), which are digital catalogues directly integrated into customers’ ordering systems.

Industrial

A partnership approach to supplying and maintaining products, solutions and services for industrial facilities

Commercial

Building maintenance and upgrades to boost energy efficiency